No problem! Although we would love for every merchant to make use of our settlement accounts, this may not work for your business, so it's important that we can offer an alternate solution that still allows you to provide Vyne as an Open Banking option to your customers.

To clarify, having a settlement account solution set up with Vyne means every time your customer makes a payment with us, the funds will land in this account for the day, likewise any Vyne refunds will process out of this same account. We then transfer the available funds as one lump sum at the end of every day to your nominated bank account.

Whereas, if you do not have a Vyne settlement account, we will never hold or physically process any of your payments, instead the funds will be processed directly to your business bank account. Whilst this is great for cashflow, in that you'll receive your funds instantly, there are other considerations to take into account, such as the requirement to manually validate and reconcile every payment against an order or that you will be required to issue manual refunds outside of the Vyne platform.

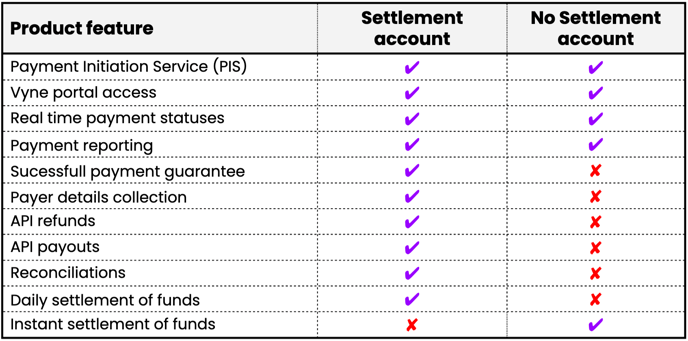

Please see below for the main product feature differences between having a settlement account and not.

Payment statuses

Regardless of which solution you have, we'll still provide you with as much transparency as we can with how a payment is progressing. We do this through a number of payment statuses, depending on how the consumer is interacting with the Vyne payment flow, and up until the payment has reached your bank account. .png?width=688&height=558&name=PIS%20-%20Payment-statuses%20-%2021032024%20(1).png)

We can only provide a status update up until the payment has been accepted by your bank. After which we have no visibility into whether the payment has actually been successful or landed in your bank account. If you find you are missing funds, we would suggest to contact your bank for clarification.

If you have any further questions about your account or would like to discuss the option of enabling settlement accounts, please don't hesitate to get in touch.